Introduction

When it comes to investments that combine beauty, historical value, and financial stability, few options can rival silver coins. For centuries, silver coins have been cherished by collectors, investors, and historians alike. Their allure lies not only in their intrinsic value but also in their rich history and the craftsmanship they embody. In this comprehensive guide, we will delve into the world of silver coins, exploring their benefits, history, and why they remain a compelling investment choice today.

The Historical Significance of Silver Coins

Silver coins have a storied history that dates back thousands of years. They were first used as currency in ancient civilizations such as Greece, Rome, and China. The intrinsic value of silver made it a preferred medium of exchange, ensuring its role in trade and commerce across continents. These ancient coins were often adorned with intricate designs, depicting gods, emperors, and significant historical events, making them valuable not only for their silver content but also as artifacts of human civilization.

Why Invest in Silver Coins?

Tangible Asset with Intrinsic Value

Unlike paper currency, silver coins have intrinsic value due to their precious metal content. This makes them a tangible asset that can provide a hedge against inflation and economic instability. In times of financial crisis, silver often retains or even increases in value, offering a secure store of wealth.

Portfolio Diversification

Investing in silver coins is an excellent way to diversify your investment portfolio. Precious metals like silver often move inversely to traditional assets such as stocks and bonds. This inverse relationship can help balance your portfolio, reducing overall risk and enhancing long-term stability.

Liquidity and Global Acceptance

Silver coins are highly liquid assets. They are recognized and accepted worldwide, making them easy to buy, sell, and trade. This global acceptance ensures that you can convert your silver coins into cash or other assets with relative ease, regardless of where you are.

Collectible Value

Many silver coins are sought after by collectors for their historical significance and rarity. Limited mintage coins, commemorative editions, and those with unique designs can command premiums above their silver content value. This collectible aspect can significantly enhance the return on investment for those who choose their coins wisely.

Different Types of Silver Coins

Bullion Coins

Bullion coins are minted primarily for investment purposes. They are valued based on their silver content, plus a small premium over the spot price of silver. Popular examples include the American Silver Eagle, Canadian Silver Maple Leaf, and the Austrian Silver Philharmonic. These coins are typically minted in high purity (usually .999 fine silver) and are a favorite among investors looking for pure silver investments.

Commemorative Coins

Commemorative silver coins are issued to celebrate significant events, anniversaries, or figures. These coins often have limited mintages and unique designs, making them attractive to both collectors and investors. Examples include the U.S. Mint’s commemorative series honoring historical events and notable figures.

Historical Coins

Historical silver coins are those that were used as currency in the past. They carry significant historical value and are often collected for their rarity and the stories they tell. Examples include the Morgan Silver Dollar, the Peace Silver Dollar, and ancient Greek and Roman silver coins. These coins can fetch high prices in the collector’s market, especially if they are in good condition and have notable provenance.

How to Start Investing in Silver Coins

Research and Education

Before diving into silver coin investment, it’s crucial to educate yourself. Understand the different types of silver coins, their historical significance, and the factors that influence their value. There are numerous resources available, including books, online articles, and coin collecting forums.

Determine Your Budget

Decide how much you are willing to invest in silver coins. This will help you narrow down your choices and focus on coins that fit within your budget. Remember that silver coins can range from relatively affordable bullion coins to high-value historical and commemorative coins.

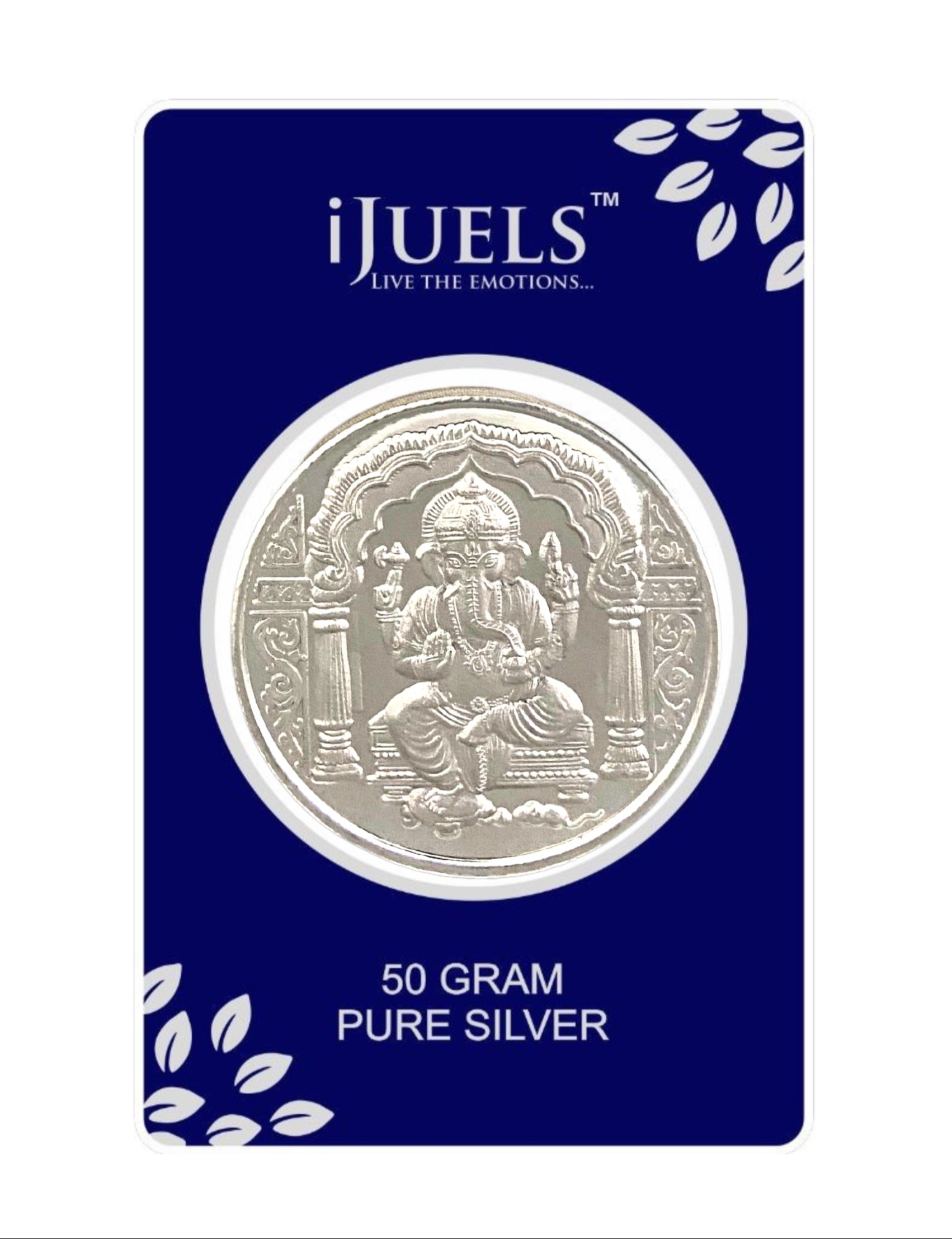

Choose Reputable Dealers

Purchasing silver coins from reputable dealers is essential to ensure authenticity and fair pricing. Look for dealers with positive reviews, professional affiliations, and transparent business practices. Websites like Ijuels offer a wide range of silver coins, providing a reliable platform for both new and experienced investors.

Storage and Insurance

Proper storage is crucial to maintaining the value of your silver coins. Keep them in a secure, climate-controlled environment to prevent tarnishing and damage. Consider using a safe or a bank’s safety deposit box. Additionally, insuring your collection can provide peace of mind and financial protection against theft or loss.

Understanding the Market Trends

Spot Price of Silver

The value of silver coins is closely tied to the spot price of silver, which fluctuates based on market supply and demand. Keeping an eye on these trends can help you make informed buying and selling decisions. Various financial news platforms and market analysis websites offer real-time updates on silver prices.

Economic Indicators

Silver prices are influenced by various economic indicators, including inflation rates, currency strength, and geopolitical events. Understanding these factors can help you anticipate market movements and optimize your investment strategy.

Collectible Market Trends

For those interested in the collectible aspect of silver coins, staying informed about market trends is equally important. Factors such as coin rarity, historical significance, and collector demand can significantly impact the value of collectible silver coins. Joining coin collecting societies and participating in forums can provide valuable insights into the market.

Conclusion

Investing in silver coins offers a unique blend of financial security, historical appreciation, and collectible enjoyment. Whether you are a seasoned investor or a novice looking to diversify your portfolio, silver coins provide a tangible asset with enduring value. The journey into the world of silver coins can be both financially rewarding and intellectually enriching, as you uncover the stories and significance behind each coin.

As with any investment, thorough research and careful planning are key to success. By understanding the different types of silver coins, their historical context, and the factors influencing their value, you can make informed decisions that align with your financial goals. With their timeless elegance and intrinsic worth, silver coins remain a treasure worth investing in. Explore the wide array of silver coins available at Ijuels and embark on your journey into this fascinating realm of investment and collection.